nuttapong/iStock Editorial via Getty Images

Investment Thesis

SeaBank is Sea Limited’s (NYSE: SE) fastest-growing segment as its loans and total customer deposits growth are exhibiting strong growth rates. Furthermore, SeaBank Indonesia has already attained profitability. I also believe this is a business that is least appreciated by many investors, although, it has the potential to be a major growth driver of the business in the long run. Investors who like to understand the business better can head over to my deep dive on SeaBank.

This article will cover SeaBank’s loans and deposit growth based on its most recent monthly financial statements, as well as ShopeePay’s launch in Brazil.

SeaBank Deposits Growth

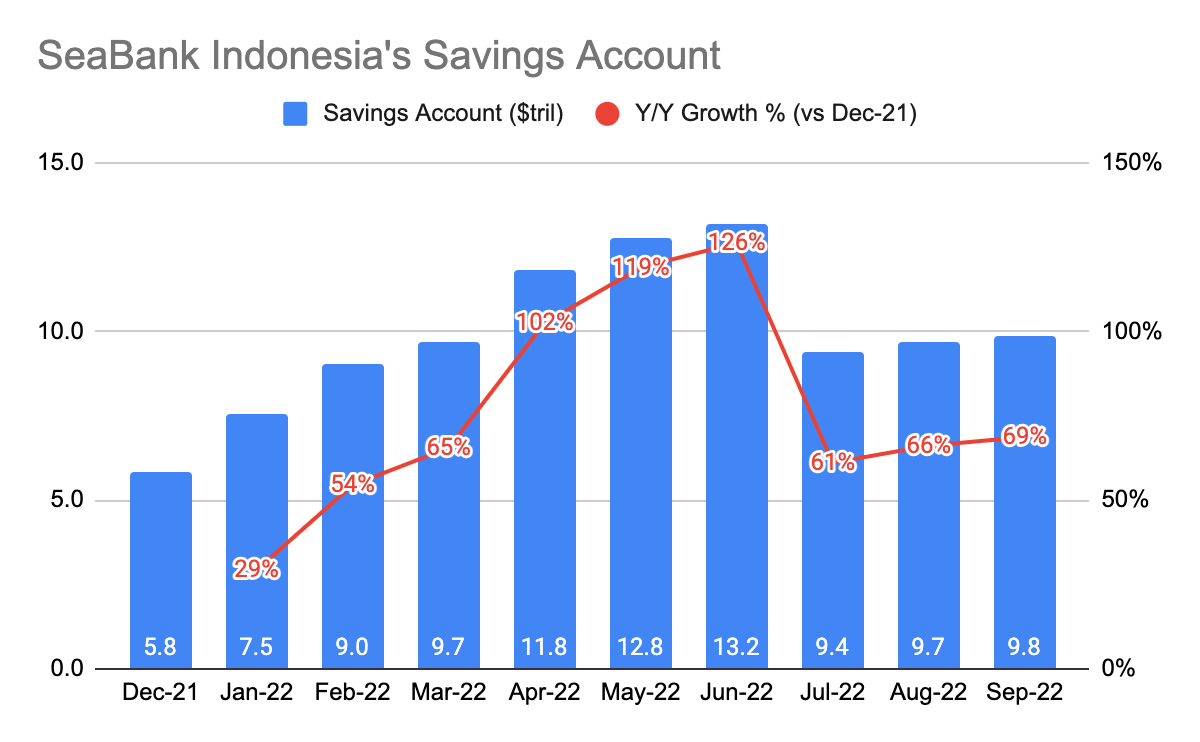

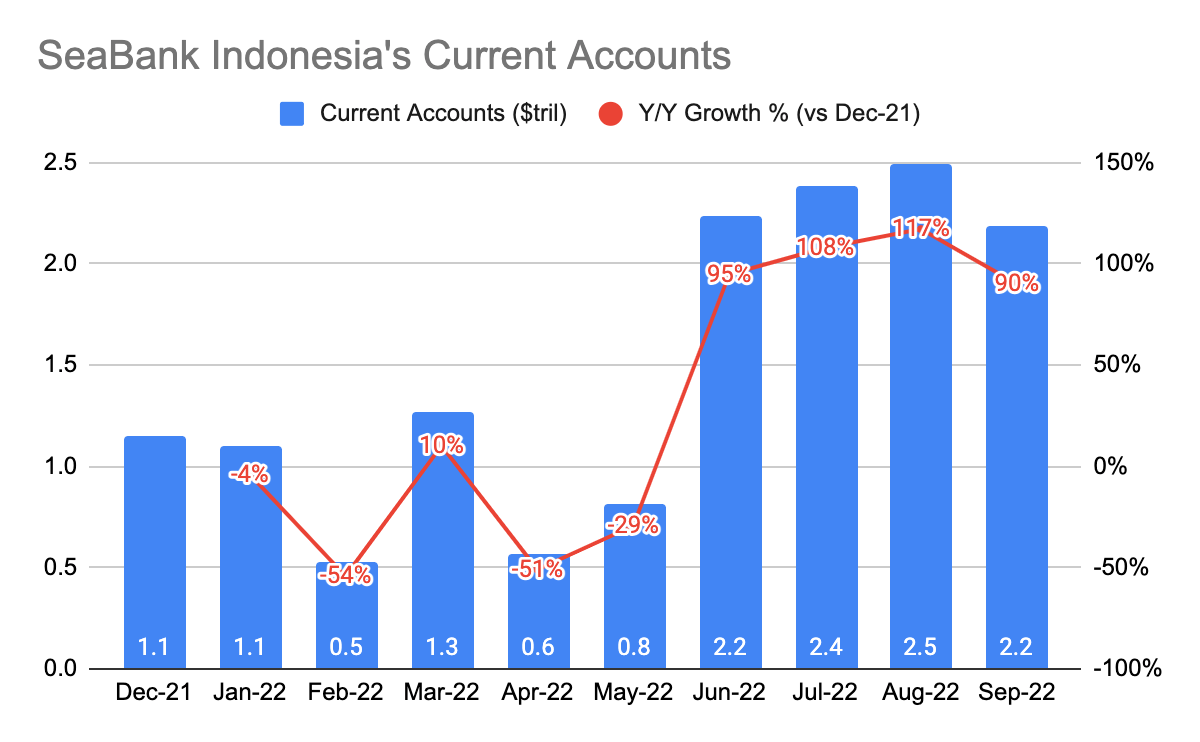

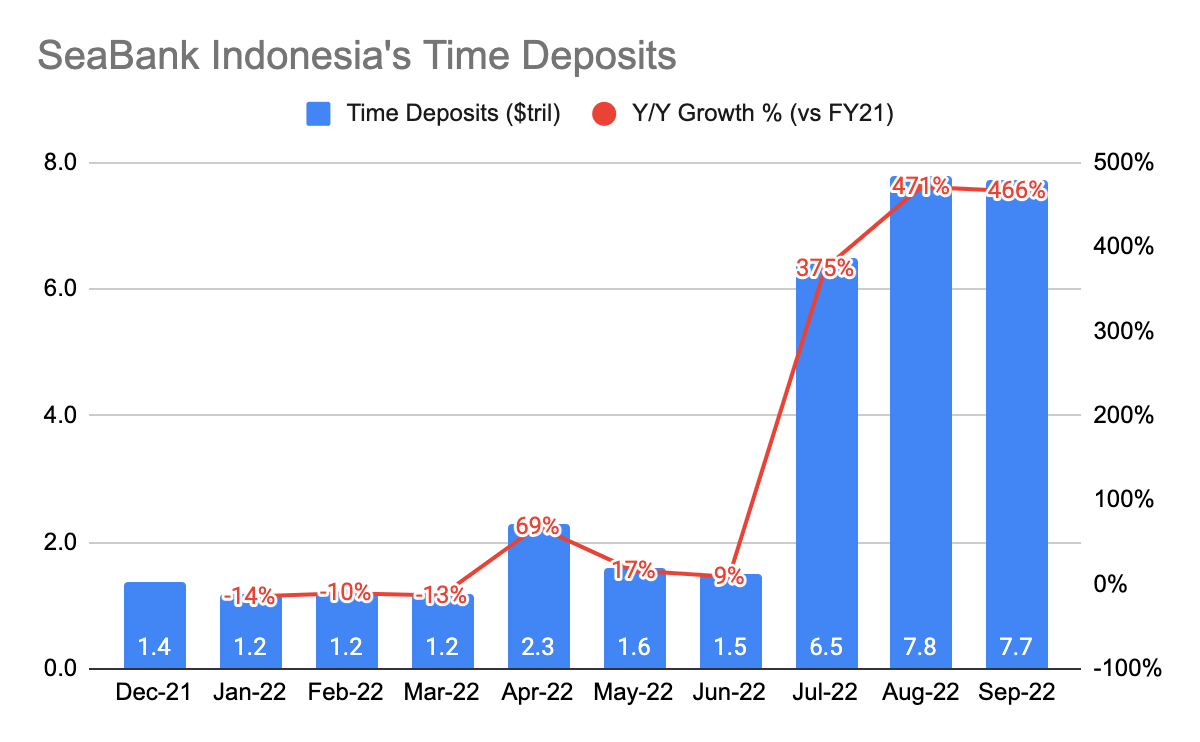

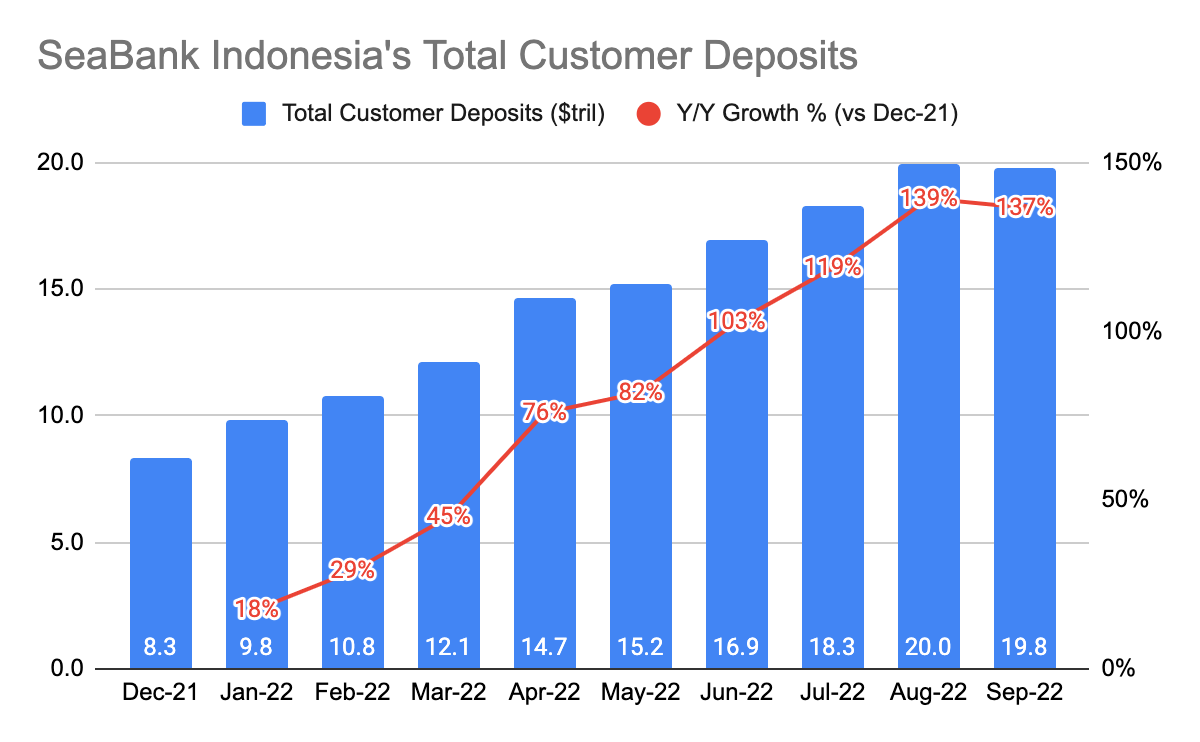

SeaBank Indonesia’s total customer deposits are broken down into 3 segments: saving accounts, current accounts, and time deposits.

SeaBank Indonesia Financials

SeaBank Indonesia Financials

SeaBank Indonesia Financials

As per its most recent Sep-22 financials, SeaBank Indonesia’s saving accounts, current accounts, and time deposits grew 69%, 90%, and 466%, respectively, on a Y/Y basis. Time deposits, which relatively has higher interest rates are increasingly making up a bigger portion of its total customer deposits, growing from 12% in Jan-22 to 39% of its total deposits in Sep-22. Most recently, they were awarded the Most Transaction Growth ATM Bersama award in 2022, and they are the largest ATM network in Indonesia. These growth rates and the award go to show how quickly they have been growing, and its competitive positioning among its peers.

SeaBank Indonesia Financials

Altogether, its total customer deposits grew 137% Y/Y as of Sep-22, which is an impressive growth with just 3 months left till the end of FY22.

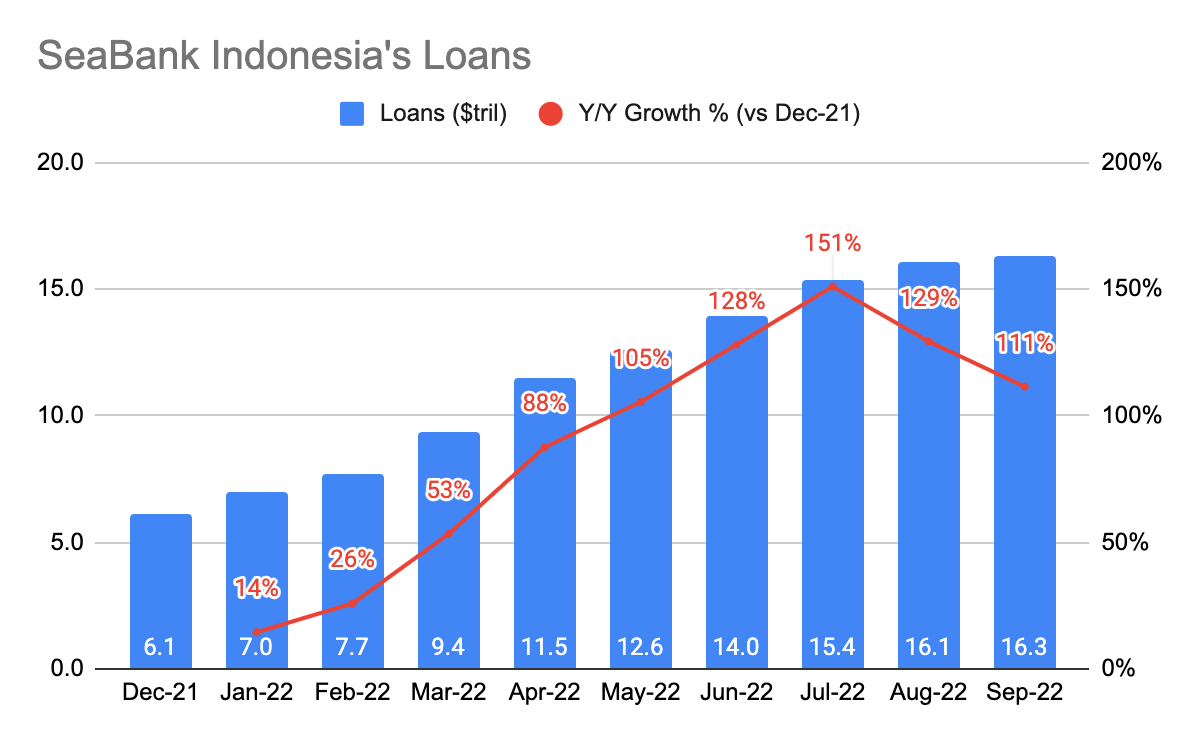

Loans Growth

SeaBank Indonesia Financials

Apart from looking at the deposits growth, we also want to look at its loans growth. Since SeaBank generates most of its revenue (also known as interest income) from loans, its loan should ideally be growing. In Sep-22, its loans grew 111% Y/Y to $IDR 16.3 trillion. Could the growth decline from Jul-22 a concern? I’d like to think not. If we were to compare it to Dec-21, this is still pretty strong growth.

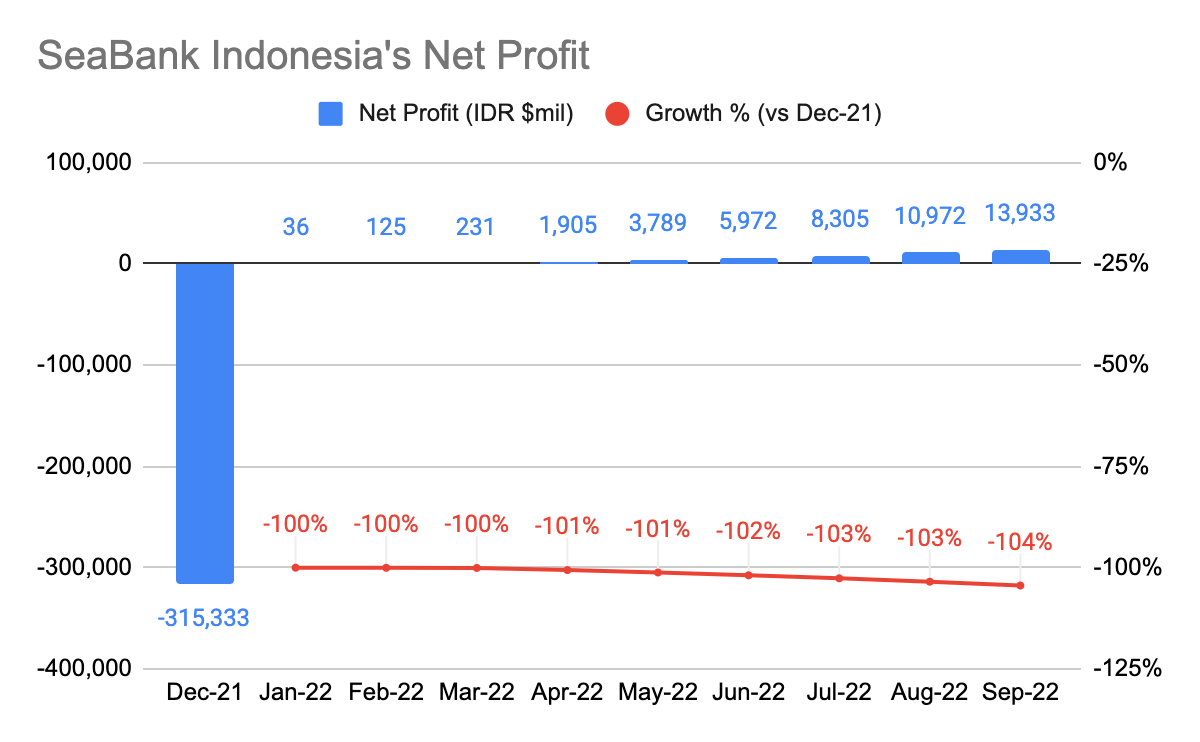

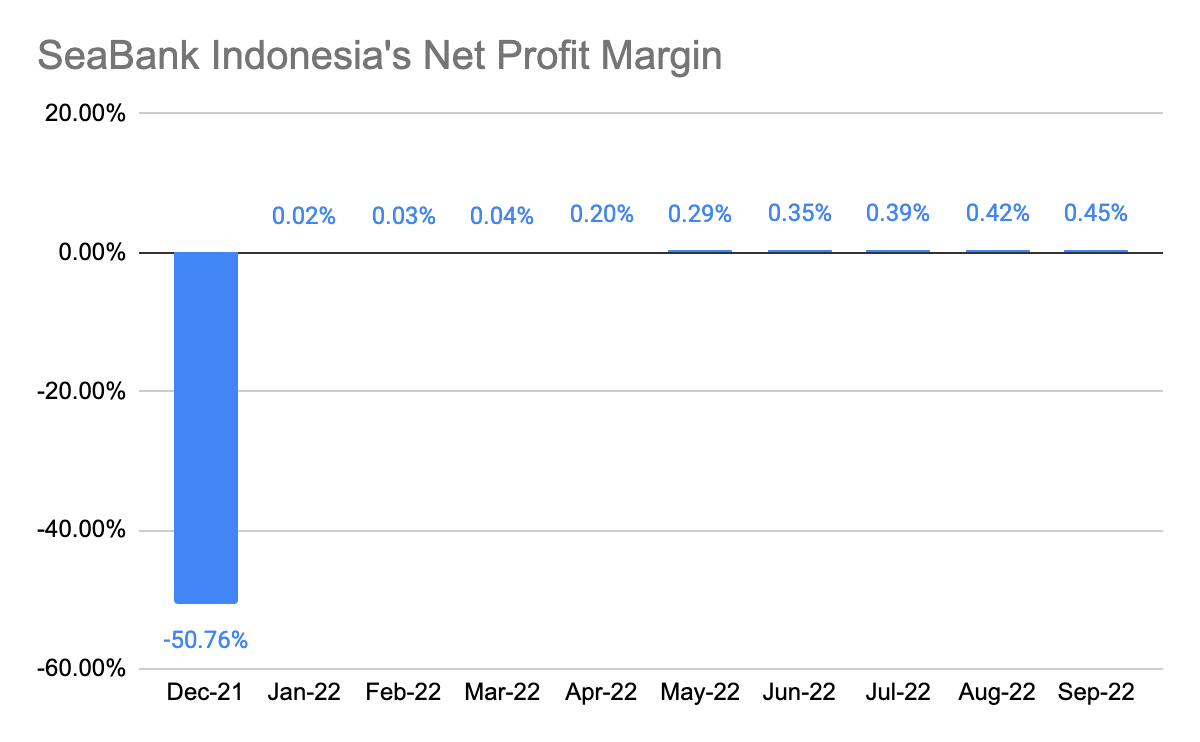

Profitability

SeaBank Indonesia Financials

SeaBank Indonesia Financials

In terms of profitability, its net profit grew 104% Y/Y to $13,933 million. As SeaBank mainly derived its revenue from loans, taking its net profit over the total interest income will give us a net profit margin of 0.45% in Sep-22, and this is a continual increase from the prior months. This increase in profitability tells us about SeaBank’s ability to self-fund its own operation. Being self-sustaining is key given the 2026 convertible notes that sitting on the balance sheet and Shopee’s race to profitability as a recession may likely occur in 2023.

Launch of ShopeePay in Brazil and Concerns Going Forward

Through a friend of mine, I discovered that Sea Limited launched Shopee Pay in Brazil. ShopeePay is an integrated e-wallet that allows users to top-up their wallet balance and use it for purchasing items on Shopee. Over the years, we have seen how digital banking services have become a natural extension of an e-commerce platform, and given Shopee’s existing user base in Brazil, gaining initial adoption will be relatively easier.

In the early days, ShopeePay in Southeast Asia (“SEA”) was able to ride on the Covid tailwind and spent huge sales and marketing dollars (“S&M”) dollars to gain adoption by offering promotions (e.g. free shipping, vouchers) and introducing new use cases through partnerships with brands and offline merchants. This was successful as SeaMoney’s overall S&M expenses as a proportion of total revenue were trending down with increasing revenue and number of users, demonstrating sales efficiency. This acts as a customer acquisition tool for its digital bank, in which afterward, services including buy-now-pay-later (“BNPL”) and SLoans can be rolled out to their user base, giving birth to its strong self-financing model.

However, this isn’t likely to be the case for Brazil given that they do not have the luxury to adopt a similar strategy. Instead, ShopeePay is likely to focus on Shopee’s merchants and users, rather than on third-party merchants and partners. This means that we are likely not to see the same speed of adoption we saw in SEA, and moreover, there are also established peers such as MercadoLibre (MELI) and Nubank (NU).

Conclusion

We’ve seen how SeaBank deposits and loans growth is progressing based on its most recent Sep-22 financials, and its profitability has continued to trend upwards. And I’ve also shared my thoughts on the launch of ShopeePay in Brazil. I believe Sea Limited’s earnings should be around the corner, and by then, I will publish my thoughts on its results. In the meantime, let me know what are your thoughts on SeaBank.

Techyrack Website stock market day trading and youtube monetization and adsense Approval

Adsense Arbitrage website traffic Get Adsense Approval Google Adsense Earnings Traffic Arbitrage YouTube Monetization YouTube Monetization, Watchtime and Subscribers Ready Monetized Autoblog

from NYSE Updates – My Blog https://ift.tt/vB6k9hW

via IFTTT

No comments:

Post a Comment