solarseven

5 years in the past, I wrote a In search of Alpha article titled Cryptocurrency Volatility Classes through which I confirmed that though cryptos are characterised by excessive volatility, the volatility was steadily declining. I additionally confirmed that cryptos had been weakly correlated with equities, providing a fascinating portfolio threat discount risk. I conjectured that volatility of cryptos would proceed to say no, and that, maybe in 5 years, a considerable variety of traders can be prepared to put 1-5% of their portfolios in crypto belongings.

This text supplies an up to date evaluation. A few of the earlier classes nonetheless apply, however there have additionally been some important modifications. My perspective is principally that of an investor primarily enthusiastic about equities, however prepared to think about the addition of some crypto to his/her portfolio.

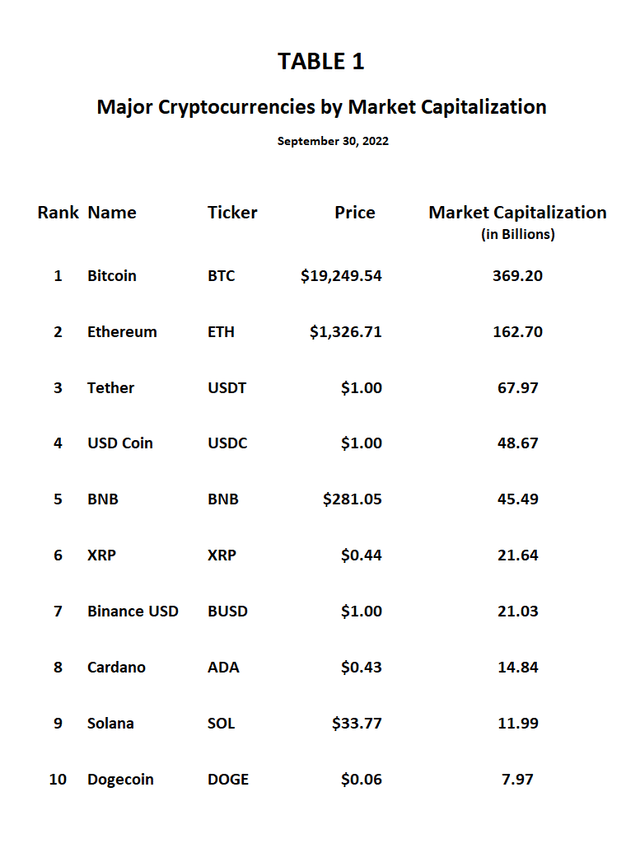

In September 2017, Bitcoin (BTC-USD) and Ethereum (ETH-USD) had been ranked one and two when it comes to market capitalization of the highest 10 cryptocurrencies and represented 76% of the entire within the prime 10. Over the previous 5 years, the market capitalization has elevated greater than five-fold, from $153.6 billion in 2017 to $771.5 billion at the moment. As of September 2022, Bitcoin and Ethereum nonetheless maintain the highest two spots and signify 69% of the entire. In addition to Bitcoin and Ethereum solely XRP (XRP-USD) (beforehand often known as Ripple) remains to be within the prime 10 checklist (see Desk 1). Seven currencies have been changed.

Creator, Knowledge from Yahoo Finance

With a market capitalization of virtually $370 billion, the market capitalization of Bitcoin alone is over twice the market capitalization of all the cryptos within the prime ten checklist solely 5 years in the past. If Bitcoin had been a inventory, its market cap would put it about 12th on the planet (as of October 6, 2022). Jaime Dimon as soon as famously referred to as Bitcoin a fraud (see my In search of Alpha article titled Bitcoin: A Bubble, Possibly, However Not A Fraud). Apparently, Bitcoin’s market cap now exceeds that of JPMorgan Chase (JPM).

Three of the newcomers to the highest 10 checklist — Tether (USDT-USD), USD Coin (USDC-USD), and Binance USD (BUSD-USD) are tied to the US Greenback. Since this text focuses on volatility, these three non-volatile currencies is not going to be mentioned additional. Additionally, as a result of information for Solana (SOL-USD) is barely out there starting in April 2020, I’ve omitted it from my evaluation. Much like my earlier article, I examine Bitcoin’s volatility to that of different cryptocurrencies, chosen shares, gold, and the US Greenback/Euro trade fee.

For comparability functions, the fairness belongings I’ve chosen are SPY (SPY) (an ETF that tracks the S&P 500), Apple (AAPL), Amazon (AMZN), Alphabet Class C (GOOG), Alphabet Class A (GOOGL), Meta Platforms (META), Netflix (NFLX), Tesla (TSLA), Block (SQ), Marathon Digital Holdings (MARA), and Riot Blockchain (RIOT). The latter two shares are engaged in crypto mining. As extra belongings, I used SPDR Gold Shares (GLD) and the Euro/US Greenback value. I used costs for the cryptocurrencies solely for a similar days the shares traded, which implies crypto buying and selling on weekends and holidays was ignored. I included each lessons of Alphabet inventory, simply out of curiosity.

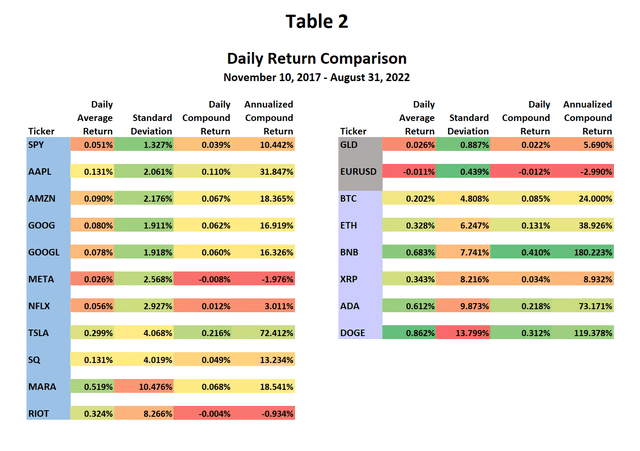

Desk 2 recaps return and customary deviation statistics for all of the belongings. Beforehand, I analyzed information via August 31, 2017. Since a lot of the crypto value information I’ve used on this article started November 9, 2017, there’s a slight hole between the 2 datasets, however I don’t assume it impacts any of the broad conclusions. The primary two days of value information had been wanted to compute the primary day by day return.

The common day by day return is an easy common, an arithmetic imply. The compound return is a geometrical imply calculated from the start and ending costs. For instance, TSLA closed at 20.20 on November 9, 2017 and at 275.61 on August 31, 2022. Word: these are split-adjusted costs. The day by day (buying and selling day, that’s) compound return was 0.299%. This may be annualized utilizing 252 buying and selling days per 12 months to get an annualized return of 72.412%.

Creator

As traders know, or ought to know, volatility hurts compound return. The geometric imply return (the compound return) is all the time equal to or lower than the arithmetic imply return. They’re solely equal for the particular case of no variability. The impression of volatility stands out in Desk 2. Cardano (ADA-USD) had a mean return of about double that of TSLA. Nevertheless, the annualized compound returns had been comparable. Why? ADA’s customary deviation was about 2.4 occasions higher.

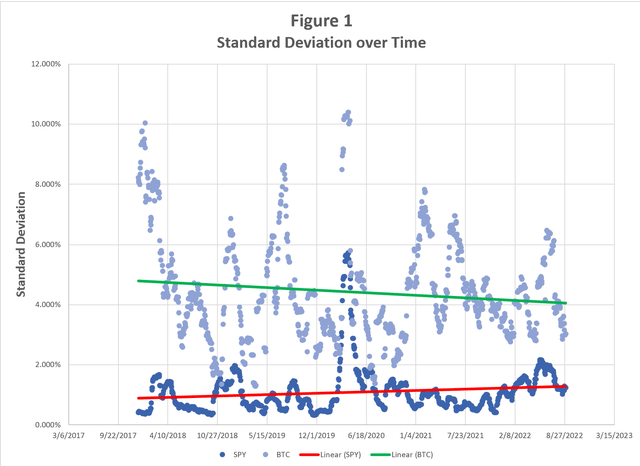

Volatility itself could be risky. To look at altering volatility, I calculated a 22-day rolling customary deviation. For instance, the usual deviation of day by day returns for the interval ending December 12, 2017 was calculated utilizing day by day returns from November 10-December 12. The calculation for December 13 used returns from November 11-December 13. You’ll be able to image this as a shifting 22-day window.

Determine 1 exhibits the usual deviation of day by day returns of Bitcoin and SPY from September 2017 via August 2022. Bitcoin’s volatility vastly exceeds that of SPY, particularly throughout sure durations, nonetheless the development, as evidenced by the inexperienced line, is down. Then again, the development for SPY, as seen by the pink line, is up. Thus, Bitcoin’s relative volatility has decreased. All through most of 2022, Bitcoin’s volatility has been 1.8-3.8 occasions that of SPY. Whereas that is excessive, previously there have been durations when it has been greater than 10 occasions greater than SPY.

Creator

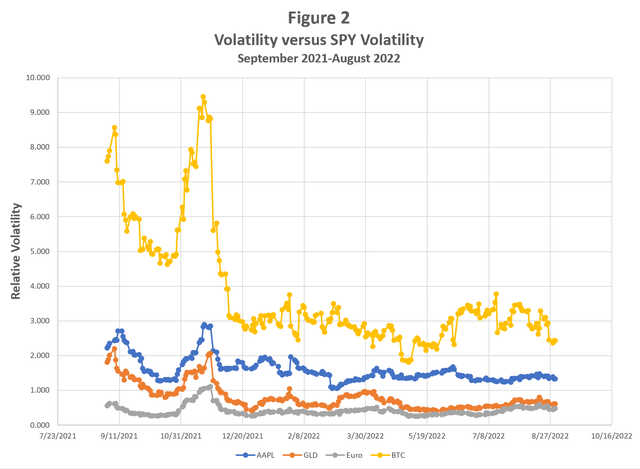

Determine 2 exhibits volatility relative to that of SPY for BTC, AAPL, GLD, and the Euro over the one-year interval from September 2021-August 2022. A price of 1 signifies that the given asset’s customary deviation was equal to that of SPY. Since December 2021 each GLD and the Euro have had decrease volatility than the SPY (values of relative volatility lower than 1) aside from one temporary interval. AAPL’s volatility has typically been about 1.5 occasions that of SPY.

Creator

Relative relationships could be difficult. An enormous spike in Bitcoin’s relative volatility on November 18. 2021 could be seen in Determine 2 and but there isn’t any big spike in Bitcoin’s absolute volatility on Determine 1 for that very same date. Why not? The reply is that SPY’s volatility was fairly low at that date, resulting in a excessive relative volatility for BTC. For the interval from December 2021 via August 2022, the relative volatilities of all 4 belongings proven in Determine 2 have been pretty secure.

As could be seen from the development line, Bitcoin’s volatility has continued to lower over time. The volatility is clearly fairly erratic, however the total development is downward. Thus, the development from 5 years in the past has continued.

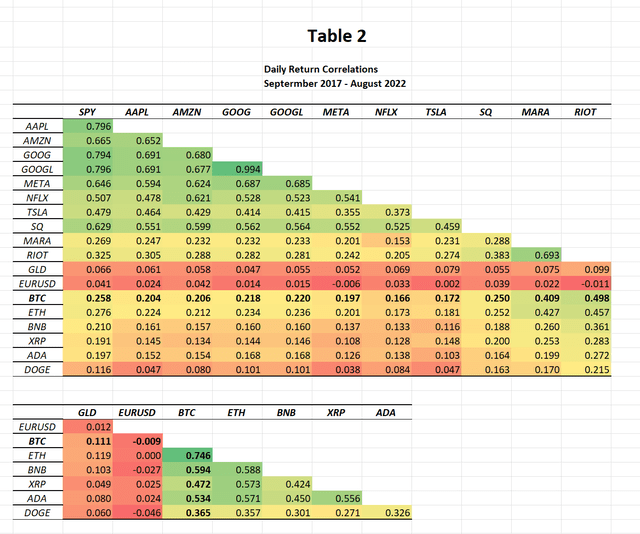

The three main inputs into Markowitz portfolio idea calculations are returns, customary deviation, and correlations. A key perception of Markowitz’s work was that it’s not essential to have destructive correlation between belongings to learn from diversification; there could be advantages even with weak constructive correlation. Desk 2 exhibits the correlation matrix for all the belongings, with greater correlations shaded in inexperienced and decrease correlations in pink.

Creator

We will see some attention-grabbing issues simply specializing in the shading. The fairness belongings are within the higher left and are principally in inexperienced with correlations starting from 0.4 to 0.8 (apart from MARA and RIOT). Good constructive correlation can be +1.000 and ideal destructive correlation can be -1.000. Two shares picked at random from the S&P 500 are inclined to have correlations between 0.2 and 0.5. The cryptocurrencies additionally are typically correlated with one another, with values starting from 0.4 to 0.7 [except for Dogecoin (DOGE)]. For an fairness investor desirous to diversify their portfolio, the decrease correlations between shares and cryptocurrencies seems to be engaging, particularly given the excessive returns on crypto over the past 5 years.

The 2 belongings that stand out as exceptions in Desk 2 are gold and the euro, which have very low correlations with all the different belongings. From a diversification standpoint, that is engaging, though the returns on these belongings over this time interval had been low, as seen in Desk 1.

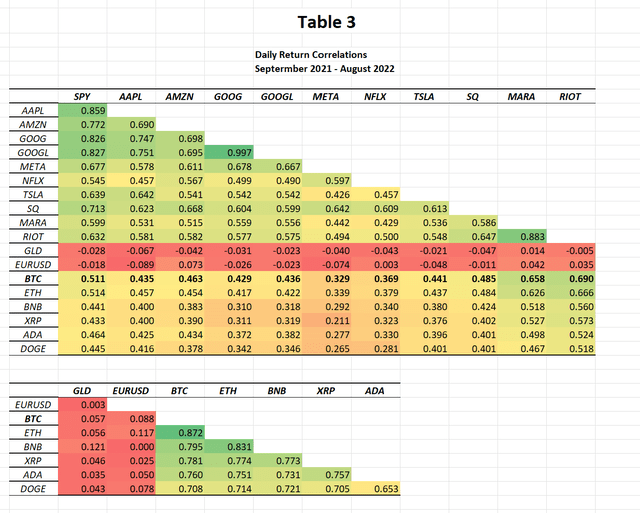

One of many many issues that makes investing tough is that relationships change over time. Desk 3 is similar as Desk 2, besides it focuses on a current one-year interval. The overall sample is comparable, however virtually all of the correlations are higher than these in Desk 2. The principle exception is GLD, which has a decrease correlation with each different asset apart from BNB.

Creator

My principal conclusions are:

- Bitcoin’s volatility has continued to lower over time, as measured by each its personal volatility and its volatility in relation to the S&P 500.

- Bitcoin’s volatility was decrease than that of the 5 different cryptocurrencies that I analyzed.

- Bitcoin’s volatility was greater than all the particular person shares I used for comparability, apart from the 2 crypto mining shares.

- Bitcoin’s compound annual return since my earlier article has been practically double that of SPY. Nevertheless, returns for 4 of the 5 different cryptocurrencies I examined had been even greater.

- Correlations between cryptocurrencies and between crypto and shares appear to have elevated.

I’d warning traders that there are lots of other ways to put money into crypto and that there are severe dangers with doing so. Desk 2 comprises a superb instance that exhibits that not all crypto investments are equal. The compound return on Riot Blockchain, which is a Bitcoin mining firm, was destructive. I’d advise traders to do intensive analysis earlier than shopping for any type of crypto.

from Cryptocurrency – My Blog https://ift.tt/7GYQrwB

via IFTTT

No comments:

Post a Comment