JamesBrey

Introduction

It’s time to look at one of the single-best sources of reliable income for investors over the past few decades – and the future, if you ask me. Southern Company (NYSE:SO) is one of America’s largest utility companies, which decided to boost its exposure to nuclear power. This decision is about to pay off handsomely as both Vogtle 3 and 4 are expected to be online by the end of next year, which will allow the company to generate free cash flow again. That’s very rare in its industry. On top of that, the company offers a high dividend yield and decent dividend growth. The only problem is that the yield has come down a bit. Southern Company isn’t the highest-yielding stock among its (large) peers anymore, which does harm the risk/reward a bit. Nonetheless, I think Southern Company is one of the best reliable income stocks one can have and many of the people I work with (including friends) own SO shares.

In this article, I will give you the details and make the case for a high-yield investment in Southern Company.

Why (High) Dividends Make Sense

But first, some theoretical background!

As most readers know, I am mainly looking for dividend growth stocks. Yet, high-yield stocks also offer tremendous opportunities. For example, adding some high yield to a portfolio allows investors to buy stocks in other companies using dividend proceeds. Moreover, and this is even more important, buying a high yield does not mean buying underperformance.

While I would say that there are more underperformance pitfalls in the high-yield space than in the dividend growth space, there are reasons to believe in buying alpha with higher-yielding stocks.

In this case, I’m going to use some research from Morgan Stanley’s Chris Poch, who summarized a number of sources into a framework that makes the case for dividend outperformance.

One of the things he brings up is that dividends indicate “quality”. A company can fake a lot of things. It can forecast things that won’t come true and it can make things look better than they really are. However, faking free cash flow is close to impossible. Hence, a sustainable dividend is a good sign. Regardless of whether the growth rate is low or not.

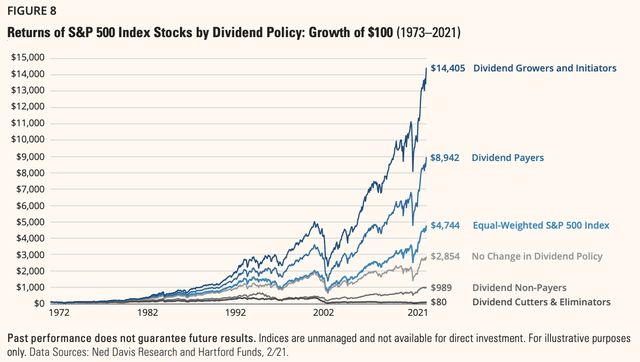

Hence, even stocks that pay a dividend but are not classified as dividend growth stocks tend to outperform the market as the chart below shows.

Hartford Funds

Moreover, and this is something I have not incorporated in earlier research, having a strict dividend policy of returning i.e., 30% to 50% of earnings to shareholders means that companies need to make wiser decisions when it comes to the use of cash. It puts more pressure on management to make wise decisions.

The difference matters (just a bit of extra yield). To quote Mr. Poch:

An investor saving $10,000 per year, who earned 7% on his money, would end up with $4,065,289 after fifty years. A similar investor earning 9% per year would end up with $8,150,836. That extra 2% per annum meant roughly double the wealth!

Whether you own small stocks, large stocks, value, growth, international, or emerging market stocks, the message is the same. On balance, you have a better chance of accumulating wealth owning a portfolio of companies that pay a dividend than if you own a portfolio of companies that don’t.

With that said, I want to add another point. Especially with regard to “boring” dividends. And let’s be honest, utilities are extremely boring.

Not making mistakes is a big part of investing. For example, let’s say you invest $5K in a meme stock for fun and lose 80%. That’s a loss of $4K. $4K is $11.4K after just 10 years of 11% annual returns. That’s a big deal.

Buying boring companies with high moats and stable business models tends to help investors avoid mistakes. Most errors are made when dealing with high volatility – at least from my experience dealing with retail investors for more than a decade.

That’s where Southern Company comes in. After all, I didn’t make up the 11% annual expected return. That’s how much the SO ticker generated over the past 23 years.

Southern Company Stands For Reliable Outperformance

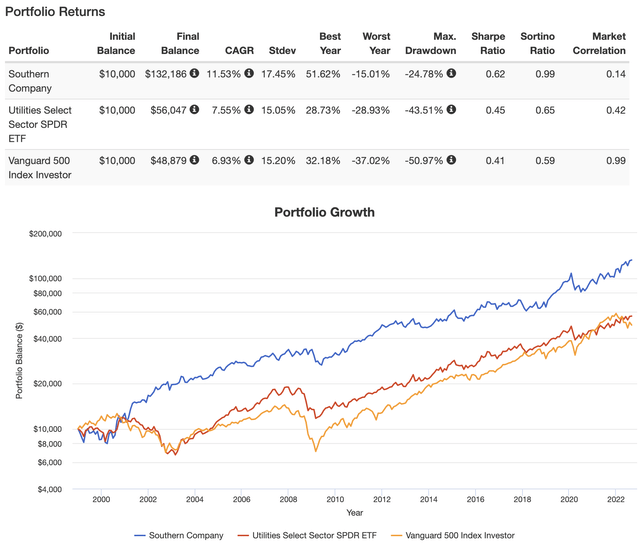

Southern Company has returned 11.5% per year, including dividends since 1999. This has beaten the S&P 500 and its utility peers who returned 7.6% and 6.9%, respectively. During this period, the standard deviation of SO shares was barely higher than the two comparison investments. Note that we are comparing a single stock to two baskets of stocks. This makes that small difference even more impressive. Hence, SO beat both investments also on a volatility-adjusted basis (Sharpe/Sortino ratios).

Portfolio Visualizer

With that said, I am cherry-picking a bit. The chart above starts with the first launch of the utility ETF (XLU). Shortly after that, the dot-com crash happened. It crushed markets but benefited high-value stocks like SO.

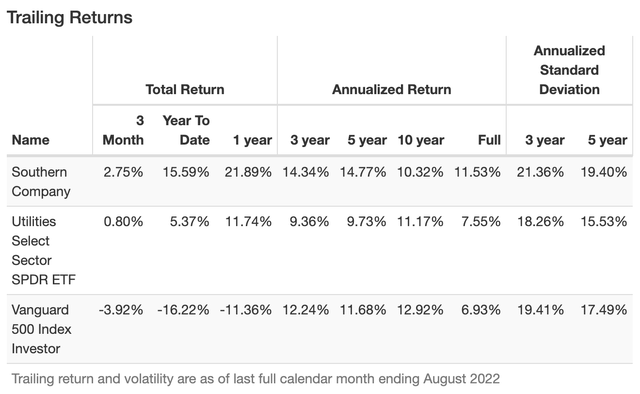

However, while SO underperformed the market over the past 10 years, it is beating the market again on a 5-year and 3-year basis.

Portfolio Visualizer

In other words, on a long-term basis, SO is still perfectly able to outperform the market.

In the case of Southern Company, outperformance didn’t just happen. It’s backed by a fascinating business. Located in Georgia, SO has become the third-largest regulated electric utility company in the United States with a market cap of $82.8 billion.

When it comes to its customer base, the company is the second-largest operator, serving more than 9 million gas and electric customers in six states.

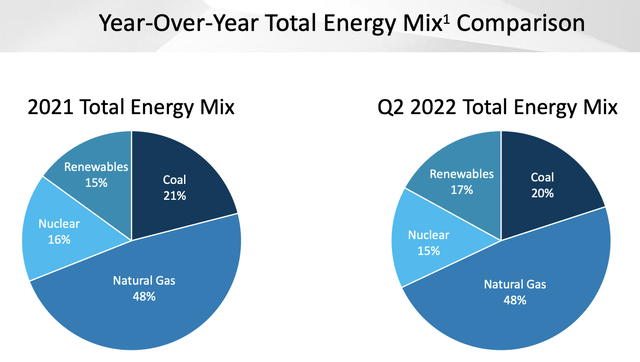

Southern Company was one of the biggest users of coal energy in the United States. That has changed. In 2007, the company produced roughly 20,460 megawatts of coal energy in 66 coal units. In 2020, that number fell to 9,800MW. In 2028, coal production will be less than 4,500MW produced by just 8 units.

As of 2Q22, the company generated 20% of its energy from coal. 48% came from much cleaner natural gas, followed by renewables and nuclear.

Southern Company

As most know, Southern Company is working on the first new nuclear power plant in the United States in roughly 30 years – Vogtle Units 3 and 4.

The company expects Unit 3 to start in 1Q23 (likely in March) after the fuel load starts in October of this year. Vogtle 4 is expected to be in service in December of 2023 if the company does not see labor issues, which could be a problem.

With all of this in mind, becoming carbon neutral by 2050 is a huge project. Shutting down efficient coal plants and building new capacity is extremely expensive. Vogtle 3 and 4 alone are forecasted to cost $10,393 through 1Q23/4Q23. The good news is that the net investment as of June 30, 2022, is $8.9 billion, which means “only” $1.5 billion is required to finish the project.

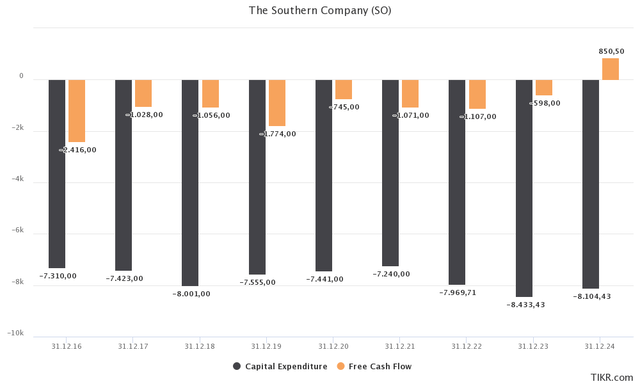

Hence, now we’re seeing something that is extremely rare among utility companies. Southern Company is expected to generate positive free cash flow after 2023. Note that free cash flow is operating cash flow minus capital expenditures.

TIKR

No major utility company is expected to generate positive free cash flow. Except for SO, which makes sense as it completes Vogtle Units 3 & 4.

In this case, $850 million in FCF translates to a yield of 1.0%. That won’t cover its dividend of close to 4%. However, it does give the company room to reduce new borrowing volume.

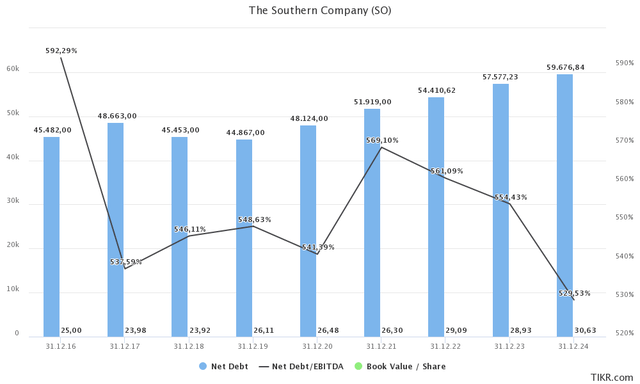

As the chart below shows, net debt is expected to increase even after 2023. That makes sense as the company needs to borrow money to distribute dividends while future investment requirements will keep a lid on free cash flow growth. However, the new borrowing volume is expected to slow. Hence, the company’s net debt ratio is expected to decline significantly. In 2024, the net debt ratio could fall to 5.3x, the lowest since Vogtle investments accelerated. Moreover, as the number at the very bottom of the chart shows, the book value per share has steadily increased. That’s basically the net equity value (total assets minus total liabilities) per share. In the 2016-2024E period, the book value per share is increasing by 2.2% per year. That’s very decent as debt is growing rapidly. It also accounts for share dilution, which is important to add. Between 2017 and 2021, the company added roughly 60 million shares, diluting shareholders by 6%.

In 2023, debt issuance is expected to be $4.3 billion. In 2024, that number is expected to drop to $3.9 billion. The 2022-2024 average is expected to be $3.2 billion, which shows the trend goes in the right direction.

TIKR

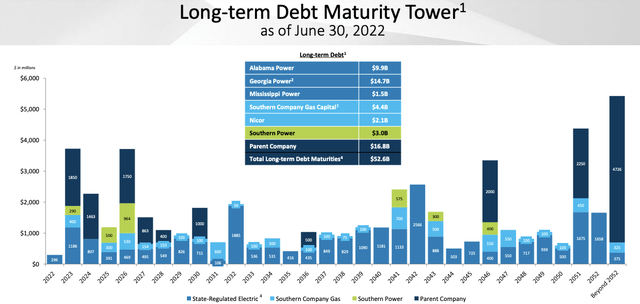

With that said, a current net debt ratio of roughly 5.6x EBITDA isn’t low, yet it’s far from unsustainable. First of all, the average coupon rate is roughly 3.6%. The average maturity is 19 years. In other words, the company is well-protected against higher rates.

Southern Company

Now, with that said, let’s look at the dividend.

The Southern Company Dividend

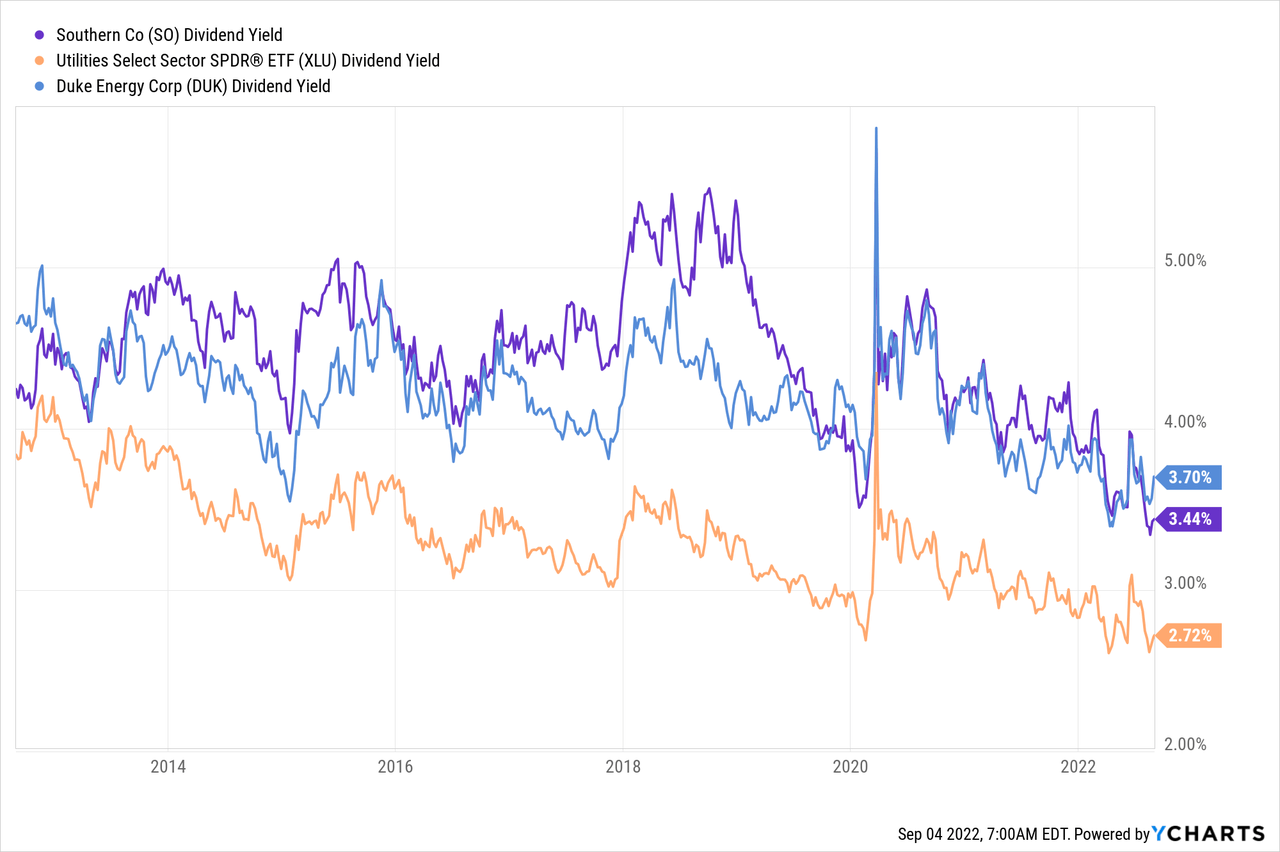

Even though Southern Company isn’t a holding in my portfolio, I have watched the stock for more than 10 years. More often than not, Southern Company was the highest-yielding stock among the large utility companies in the United States.

Southern Company is now once again yielding less than my largest utility holding Duke Energy (DUK), which is quite rare as investors simply required a higher yield given the higher risks tied to Vogtle investments.

The good news is that Southern Company is still yielding well above the sector average.

Shareholders currently receive $0.68 per share per quarter. That’s $2.72 per year and 3.5% of the company’s stock price, so slightly higher than displayed in the chart above.

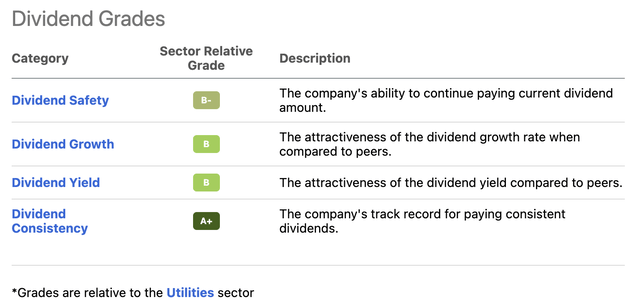

Using the company’s dividend scorecard – provided by Seeking Alpha – we see that SO scores high on consistency and relatively high on safety, growth, and yield. Note that all numbers are relative to the utility sector.

Seeking Alpha

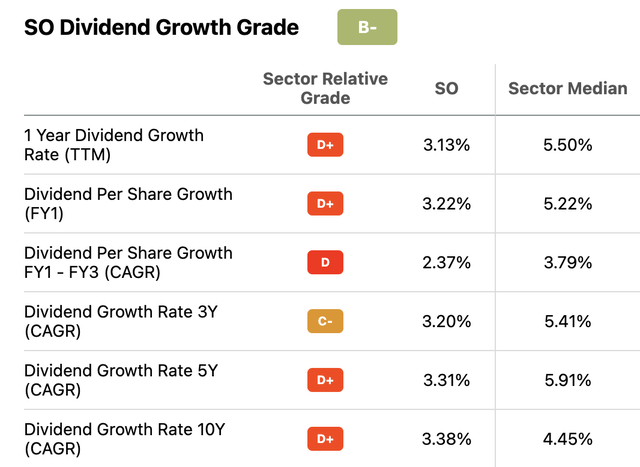

However, as I wrote in my last article, dividend growth is worse than the table above suggests. When we dig deeper, we find that the CAGR dividend growth rates of the past 3, 5, and 10 years are well below the sector median.

Seeking Alpha

The most recent hike took place in April of this year, which was 3.0%.

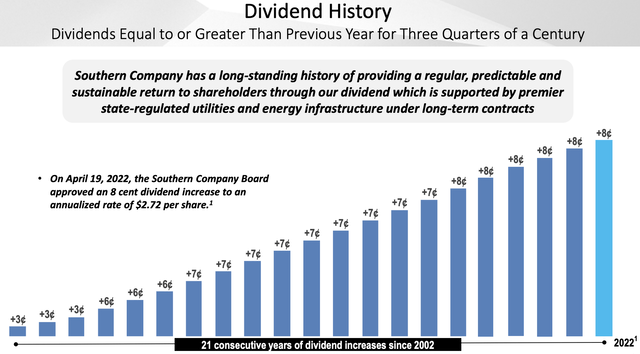

While there is absolutely no denying that 3% dividend growth is bad, there is some good news. In “normal” circumstances, this yield beats inflation. Moreover, the company has had 21 consecutive annual hikes since 2002.

Southern Company

Moreover, dividend growth could rise in the years ahead. Not by a lot, but when dealing with high yield, even small hikes matter (see my example at the start of this article).

For example, long-term EPS growth is expected to be in the 5% to 7% range.

Southern Company’s adjusted earnings guidance range for 2022 is $3.50 to $3.60 per share vs. consensus of $3.55. In the first quarter of 2022, management estimates Southern Company adjusted earnings per share will be 90 cents. Management continues to project a long-term adjusted earnings per share growth rate for Southern Company in the 5% to 7% range, consistent with adjusted earnings in a range of $4.00 to $4.30 per share in 2024 vs. consensus of $4.11.

That could push dividend growth back towards 4% and still leave SO with more room to reduce debt.

Moreover, there’s now less risk as we move towards the completion of both Vogtle units, which brings me to the next part.

Valuation

In early August, UBS came out upgrading Southern Company to buy with an $87 target. As reported by Seeking Alpha:

UBS analyst Ross Fowler believes the “Vogtle risk premium in shares should wane and the market should begin to apply historical premiums to Southern prior to new nuclear construction issues for first quartile regulation,” noting the stock had traded at an average 17% premium to the average regulated utility prior to new nuclear construction.

Fowler expects both Vogtle units moving to an in-service rate base will generate cash of $600M-$700M.

I agree with these comments given my view on Vogtle in this article. I’m also happy that my bullish call on SO is working out quite well so far.

However, I’m not happy that SO is doing so well for one reason only – and it’s a selfish one. I wouldn’t mind buying some SO as it would go well with my DUK position. I am a big believer in nuclear power and think SO is putting itself in a fantastic position to outperform its peers.

SO used to be a slow and boring stock with a high yield. Now it still has a high yield, but it’s slow no more.

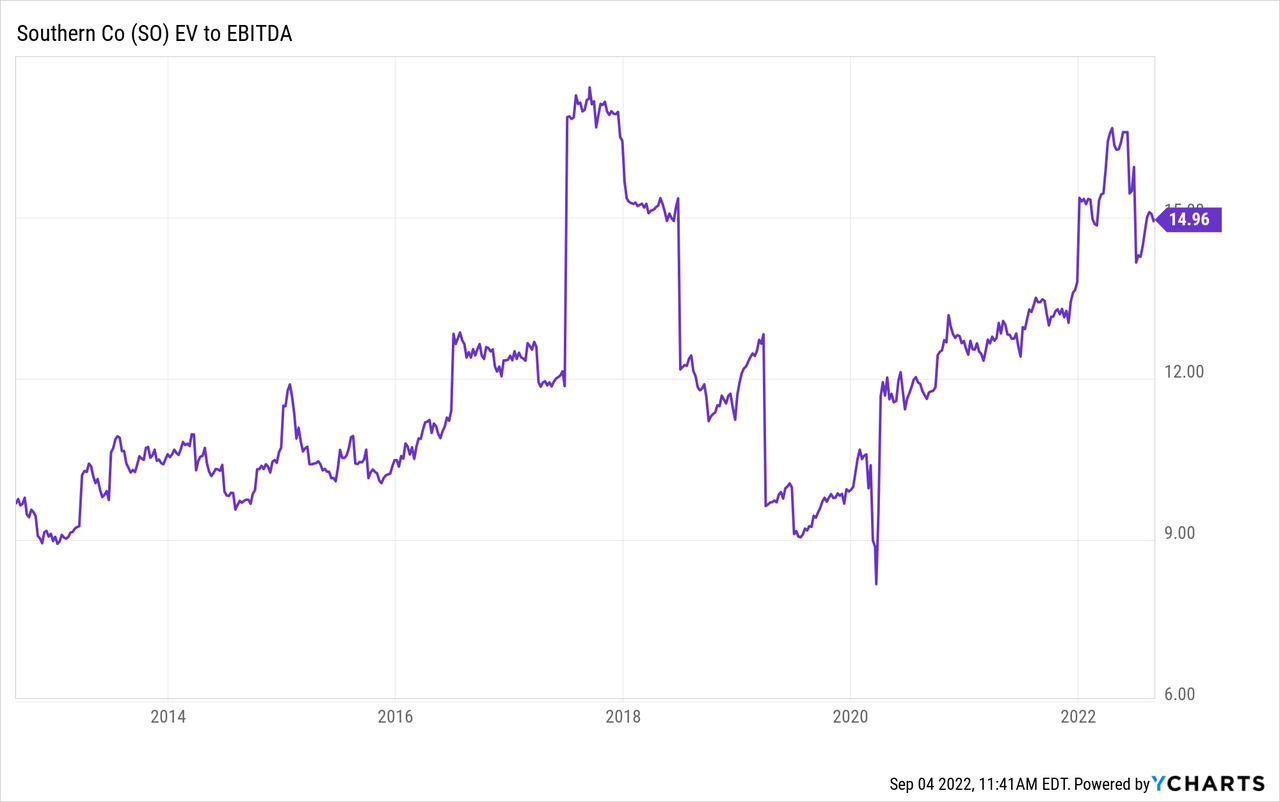

With that said, the company is trading at 14.1x 2023E EBITDA of $10.4 billion using the company’s $82.8 billion market cap, $57.6 billion in expected 2023 net debt, $1.5 billion in pension-related liabilities, and $4.5 billion in minority interest.

That’s not a great valuation as investors have started to price in higher growth and less risk going forward.

There’s nothing wrong with buying SO at current prices. Yet, if I were to plan a bigger position, I would look for a pullback of at least 5% to make the yield and valuation just a bit better.

Takeaway

I started to really like SO this year. It’s a trusted source of income for many investors, which provides a decent yield, steady (but low) dividend growth, and a recession-proof business model. Moreover, the company is moving towards the completion of both Vogtle units by the end of next year with Vogtle 3 coming online early next year. This will make it much easier for SO to deal with its net-zero transformation as it frees up a lot of funds. Debt will rise much slower, allowing management to accelerate shareholder value creation.

EPS growth is set to remain high, providing management with the opportunity to increase long-term dividend growth rates.

The only problem is that the surge in SO shares has made the dividend yield a bit less attractive compared to usual SO yields. That makes sense as the company is “de-risking”, yet I’m still a bit disappointed.

Other than that, there’s not a lot to it other than buying SO on weakness whenever it occurs. The company and the basic math behind compounding returns should do the rest.

(Dis)agree? Let me know in the comments!

Techyrack Website stock market day trading and youtube monetization and adsense Approval

Adsense Arbitrage website traffic Get Adsense Approval Google Adsense Earnings Traffic Arbitrage YouTube Monetization YouTube Monetization, Watchtime and Subscribers Ready Monetized Autoblog

from Top Stock To Invest – My Blog https://ift.tt/lsF3bNo

via IFTTT

No comments:

Post a Comment